What John Oliver Didn't Have Time To Say In His Hilarious Exposé Of Herbalife And MLM

By Robert FitzPatrick

Summary

The popular HBO show, Last Week Tonight with satirist John Oliver, skewered the multi-level marketing industry this week. Investors take note. Six million people have watched the show on YouTube.

Oliver portrayed all MLMs as pyramid schemes, based on pay-to-play purchases, and recruiting for income. He also showed deception, losses, false medical claims and preposterous claims and denials.

Herbalife came in for special mockery, in particular the claims and antics of its CEO, Michael Johnson.

Recognizing Oliver as a harbinger and igniter of public awareness, it is useful to review the four defining characteristics of a pyramid scheme and measure MLMs against them.

If a satirist can get to the heart of the MLM business model in 30 minutes, how much longer before the FTC and SEC connect the dots.

By now it is unlikely that any investor in a "multi-level marketing" company, e.g., Herbalife (NYSE:HLF), Nu Skin (NYSE:NUS) and Usana (NYSE:USNA), has not already watched satirist John Oliver's devastating and  hilarious treatment of the MLM "industry" on HBO or YouTube. If not, with already six million online views of the show in just a few days, those investors might want to pay attention. Knowing why Oliver portrayed MLMs as a public menace may prove more valuable than P/E ratios or Carl Icahn stock purchases.

hilarious treatment of the MLM "industry" on HBO or YouTube. If not, with already six million online views of the show in just a few days, those investors might want to pay attention. Knowing why Oliver portrayed MLMs as a public menace may prove more valuable than P/E ratios or Carl Icahn stock purchases.

Highlighting MLM's circus-style diversions and spectacle, mind-boggling denials, unconscionable income promises, outrageous manipulation and the squandered time and savings of untold millions of people, Oliver put a name to the whole MLM business: Pyramid Scheme.

"Pyramid Scheme" is at the heart of all controversies about MLMs. This is the volatile label the FTC famously did not use in its prosecution of Herbalife, though, after quoting what the FTC actually did say about Herbalife in its July 15, 2016 complaint, Oliver pointed out the obvious: the FTC's detailed description of Herbalife, point by point, matched a description of a pyramid scheme. He got a big laugh contrasting the FTC Chair's clarification that Herbalife was "not determined not to be a pyramid scheme" with CEO Michael Johnson's Orwellian claim that the FTC had done exactly that - determined Herbalife not to be a pyramid scheme.

Ms. Ramirez emphatically stated that the FTC "does not endorse" such statements of exoneration. Nevertheless the Wall Street Journal immediately reported, "the company will not be classified as a pyramid scheme." This oblique and misleading report from the WSJ that omitted Ms. Ramirez actual statement about Herbalife's pyramid scheme status, started an avalanche of reality-reversals, each more emphatic. "Herbalife no pyramid scheme: FTC" headlined the New York Post, and so it went… until the John Oliver show.

Before diving into how and why MLMs are pyramid schemes, Oliver wiped the sheen off Herbalife's façade of legitimacy and portrayed the company, its CEO, his claims and antics and those of similar MLMs like Market America as nothing more than medicine show chicanery, so obvious and absurd as to be deserving of unmerciful ridicule. Herbalife's Michael Johnson came in for special mockery when he tried to equate Herbalife's multi-tiered recruiting-based compensation plan to the traditional corporate ladder. As Oliver pointed out, everyone in the corporate model is salaried with benefits and has no mandate to recruit more "supervisors" or buy the company's products. In fact, Oliver stated, a sustainable corporate structure is the very opposite of Herbalife.

The image of Johnson literally wrapping himself in a Mexican flag on stage to lure struggling Mexicans into his scheme where 99% will lose their money was given a name by Oliver that I won't repeat here. Those who see the video, though, won't forget it and will likely never take Michael Johnson seriously again.

At the end of the show, Oliver joined Latino actor Jaime Camille in establishing the show's own pyramid chain letter to spread the word in English and Spanish to avoid joining any MLM. The videos of this show are top trending on YouTube.

Pyramid as Source of Harm, Losses, Deception

John Oliver's researchers apparently concluded that all the various controversies and abuses associated with MLMs are the consequences of its pyramid scheme design and operation rather than attributable to conventional commercial abuses such as predatory policies, greedy leaders, unfair pay plans or a corporate culture of deception, though all that is in evidence. They also realized that, essentially, all MLMs are the same. Trickery, lying, and losses, as well as "lack of retail sales", which were discussed in the show, are intrinsic to a pyramid scheme, including:

- 99% of consumers are unprofitable

- actual "income averages" are not disclosed or obscured

- churn rates are massive and are always covered up

- owners and top recruiters get virtually all the money while virtually no one else makes a dime.

- little or no retailing, despite being called "direct selling."

- products are absurdly priced and insanely hyped for having miraculous (and obviously false) health powers.

- inexplicable "growth" even when the economy tanks, there is no demonstrable "demand" for the scheme's "product" and 80% of the salespeople quit each year.

- targeting economically vulnerable people

- majority of revenue ultimately comes from the MLM participants, not the general buying public.

As all these "unfair and deceptive" practices flow from the same source: the inherently deceptive and unfair pyramid scheme model, and since Oliver is frequently a harbinger and an igniter of greater public awareness of issues he addresses, it will be useful to revisit the fundamentals that define a pyramid selling scheme and that cause all those consumer injuries and outrages.

As Oliver's show depicted it with humor and incisiveness, when the basics are understood, "MLM" and "pyramid scheme" are revealed as one and the same.

1. Endless Recruiting Chain.

Strangely, this first and most defining element of a pyramid scheme is the one least acknowledged as a source of harm. Over the last 40 years, the "endless chain", has gained a legal status and its impossible promise of reward to all who are recruited is allowed as a marketing "incentive." MLM, the trail blazer for this new form of "legal" deception, is founded on and uniquely identified by the endless chain "model."

In the not too distant past, the detection of an endless chain promise in which rewards to each participant are contingent upon recruiting other participants, was outlawed on its face. This prohibition extended also to the offers of a lower advertised sales price contingent only on the buyer recruiting referrals who also bought.

In MLM, the rewards, including discounts are absolutely contingent  on recruiting (referrals). A clip of me explaining to CNBC's Herb Greenberg the iron-clad mathematical reason for outlawing endless chain promises was included in the Oliver show. It simply reveals that the promise cannot be fulfilled. The plan self-destructs. If the scheme itself does not implode, then it systematically and continuously pillages the "last ones in", and they will always be the vast majority of the total. This is fraud per se. Yet, somehow, due to one ambivalent court ruling (Amway, 1979) and the political muscle of MLMs to capture regulators (NASDAQ:FTC), the endless chain income promise became enshrined in MLM as a "business model."

on recruiting (referrals). A clip of me explaining to CNBC's Herb Greenberg the iron-clad mathematical reason for outlawing endless chain promises was included in the Oliver show. It simply reveals that the promise cannot be fulfilled. The plan self-destructs. If the scheme itself does not implode, then it systematically and continuously pillages the "last ones in", and they will always be the vast majority of the total. This is fraud per se. Yet, somehow, due to one ambivalent court ruling (Amway, 1979) and the political muscle of MLMs to capture regulators (NASDAQ:FTC), the endless chain income promise became enshrined in MLM as a "business model."

In MLM, a perpetual promise of income is made based on money from later participants being transferred to earlier ones, requiring the chain, by definition, to be "endless". Unless new recruits are found, the newest participant suffers loss of investment and time. In MLMs, each new person, no matter how long the scheme has run or how large it is, is falsely told he/she has exactly the same opportunity as the first that joined and is charged the same price. MLMs traffic in the fictions of infinite expansion, and "unlimited income". On its face, this is fraudulent.

In using the endless chain promise, despite its inherent impossibility, MLM crosses over from the realm of economics into the "occult", claiming the power of magic. It is due to this claim to miraculous economic power that some MLMs are able to operate "cults", in which all followers can be promised "eternal" (financial) bliss. They are told they must believe in the promise (and pay) to gain the "unimaginable" rewards. They are also told they will face a life of excommunication, failure and shame should they entertain doubt of their exalted leaders or abandon membership.

2. Pay-to-play (and its Disguises)

A pyramid selling scheme or its older its cousin, the chain letter, that charges nothing to participate may still claim magical power of infinite expansion, but since it charges nothing, it passes from fraud to fancy. Any benefits someone might gain from such a scheme can only be from some innocent activity connected to it, such as actual retailing or getting letters containing positive messages. The participant's own money is not put at stake in the non-charging endless chain reward promise and therefore the scheme cannot cause real harm.

As evidence of this, John Oliver himself launched his own pyramid  scheme at #thisisapyramidscheme. The satirical scheme, which is now promoted all over the internet, promises that if each person watches the John Oliver video on MLM and sends it to five other people who do the same, it will reach every person on earth in just 14 referral cycles! The reward? Not being duped by a MLM!

scheme at #thisisapyramidscheme. The satirical scheme, which is now promoted all over the internet, promises that if each person watches the John Oliver video on MLM and sends it to five other people who do the same, it will reach every person on earth in just 14 referral cycles! The reward? Not being duped by a MLM!

scheme at #thisisapyramidscheme. The satirical scheme, which is now promoted all over the internet, promises that if each person watches the John Oliver video on MLM and sends it to five other people who do the same, it will reach every person on earth in just 14 referral cycles! The reward? Not being duped by a MLM!

scheme at #thisisapyramidscheme. The satirical scheme, which is now promoted all over the internet, promises that if each person watches the John Oliver video on MLM and sends it to five other people who do the same, it will reach every person on earth in just 14 referral cycles! The reward? Not being duped by a MLM!

In contrast to Oliver's public-service pyramid scheme that costs nothing to join, publicly-traded MLMs, like Herbalife, Nu Skin and Usana, are steeped in pay-to-play charges, giving them power to inflict enormous losses upon millions of people. The payments for each participant can reach into the thousands and tens of thousands, consisting of initial payments and quota-driven ongoing purchases tied to gaining or maintaining access to future participants' investments.

While, in MLM the endless chain now operates openly, the pay-to-pay element, involving actual payments and documented financial losses on a vast scale, needs a proper camouflage. In MLMs, this camouflage is product-purchase-transactions. In a market economy, buying or selling goods can have a diverting effect on people, giving the commercial transaction a presumption of market legitimacy and obscuring its underlying fraudulence. It is useful, therefore, to see another form of camouflage that another type of pyramid scheme uses and that also successfully dupes millions of Americans and many more worldwide.

Gifting Scheme as Mirror of MLM

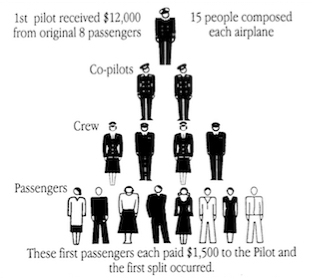

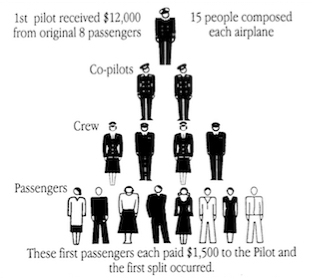

Millions of Americans have joined (and continued to join) what are called "gifting schemes. Gifting schemes exploded in the mid-80s with many called the "Airplane Game", using silly titles to identify participants at each pyramid level. As pyramid prosecutions by the FTC waned under George W. Bush the gifting schemes reappeared on an even larger scale in the early 2000's aimed mostly at women, now with new names such as "Women Empowering Women." They were popular - and dangerous - enough to be featured in Ladies Home Journal, the Oprah Winfrey show, and NBC News to warn women against the claims and explain how they work.

The gifting scam is a simple pyramid scheme with four levels, and 1,2,4 and 8 positions in each level respectively. The bottom eight participants' money goes directly to the one person at the top. The two below them then become the top positions of two spit groups, and the four divide into two each, and the last eight divide to four positions each, with both new units now needing to add 8 new people to get their money, and so on. Recruiting 8 becomes a mandate to recruit 16, then 32, 64, etc.

1,2,4 and 8 positions in each level respectively. The bottom eight participants' money goes directly to the one person at the top. The two below them then become the top positions of two spit groups, and the four divide into two each, and the last eight divide to four positions each, with both new units now needing to add 8 new people to get their money, and so on. Recruiting 8 becomes a mandate to recruit 16, then 32, 64, etc.

1,2,4 and 8 positions in each level respectively. The bottom eight participants' money goes directly to the one person at the top. The two below them then become the top positions of two spit groups, and the four divide into two each, and the last eight divide to four positions each, with both new units now needing to add 8 new people to get their money, and so on. Recruiting 8 becomes a mandate to recruit 16, then 32, 64, etc.

1,2,4 and 8 positions in each level respectively. The bottom eight participants' money goes directly to the one person at the top. The two below them then become the top positions of two spit groups, and the four divide into two each, and the last eight divide to four positions each, with both new units now needing to add 8 new people to get their money, and so on. Recruiting 8 becomes a mandate to recruit 16, then 32, 64, etc.

Without need of court rulings or extensive investigation, police and regulators now treat gifting schemes as pyramid frauds. Yet, millions of educated Americans have believed they are legitimate and legal. How so? The scheme's promoters argue that no one is "paying" to join, nor are they receiving "rewards for recruiting." They claim with straight-faces that each person's money is freely given as "gifts" without guarantee or even expectation of future reward. The 800% rewards - $1500 to participate at the bottom level becomes $12,000 for the top position after the last 8 join - is received as "gifts", not as a reward for having recruited those 8.

The regulators and courts do not buy this story. They say what are called gifts-given are indeed charges for joining the chain and what are called gifts-received are indeed recruiting-based rewards. The courts have noted that more than 90% of all who join will never get rewarded due to the pyramid design. (At any given point in time as the scheme unfolds, 90% will have given their "gifts" but not received any in return.)

Strangely, the gifting scheme is viewed as inherently deceptive due to the "endless chain" promise, the very same promise offered in all MLMs where it is treated as a "sales incentive." In the gifting schemes regulators see no need to quantify actual losses in order to establish consumer harm. A quick calculation based on the pay plan reveals the inevitable proportionate losses among all who join. Regulators also see no need to prove that the participants actually paid money with expectation of recruiting rewards, rather than just gave cash "gifts" as they claim. Yet, in MLM, the FTC assumes the nearly impossible burden of proving that MLM participants paid money and bought MLM goods as part of a plan to make money in recruiting rather than as ordinary consumer purchases, based on "love of product."

The gifting scheme's claim of giving and receiving, in the context of the recruiting mandate and reward promise, is recognized as purely a camouflage, a phony story. The story is embellished by promoters as a non-competitive, sharing network, to end poverty and spread abundance. Gifting scheme Believers proclaim a vision of world prosperity though the gifting program and blind themselves to its mathematical impossibility, such is the power of a promise of "unlimited income" and the elusiveness of "exponential expansion."

Though the gifting scheme's camouflage story is not good enough to fool regulators, apparently it had enough power that a bill was introduced into the legislature in Texas in 2001 to legalize the gifting scheme, based on that story of "giving" being legally distinct from making payments and receiving "gifts" being legally distinct from getting recruiting rewards. State law enforcement officials opposed the bill and it never became law. (Houston Chronicle, 02/17/01, Page 33) But, that it got that far shows the extent to which pyramid promoters will go to keep law enforcement from interfering with their ill-gotten profits. They will swear to the most ridiculous disguise and rationalization.

If the law enforcement officials did not act, the gifting scam would only proliferate and become more accepted, even as it always caused 90+% losses. Only because law enforcement rejected the phony story and recognized the endless chain recruiting promise as inherently fraudulent gifting schemes have been contained.

The MLM "Story"

MLM has its own camouflage story, only slightly better than the gifting tale, but not much less absurd or transparent. It claims that payments to join and participate in the "unlimited" pay plan are not payments at all. They are ordinary consumer "purchases." And the rewards that are paid only to those who recruit are not recruiting rewards at all, but conventional commissions on those ordinary consumer purchases, made by others that join the plan. Even though only those that recruit can gain the rewards, and even though only those who purchase the products qualify for rewards when they recruit, MLM is generally treated by the government as "direct selling."

The official story that people "buy" the goods and get paid "commissions" on "sales" is accepted as valid. The endless chain and the pay-to-play purchasing quotas are overlooked as if they do not exist. It is for this reason that many people call MLMs, "fraud in plain sight" and wonder how the FTC keeps letting such schemes operate, as John Oliver publicly asked in his show. (He concluded it is due only to political lobbying and noted that two former FTC Commissioners, (Pamela Harbour and Jon Leibowitz) are now on Herbalife's payroll.)

Political Fix

It must be noted here that recent court rulings against various MLMs, e.g., Fortune High Tech Marketing, Vemma, Burnlounge, Zeek Rewards, and Herbalife, are now enabling or supporting FTC and SEC prosecutions, putting "regulatory capture" in jeopardy. The MLM "industry" has, therefore, ramped up the influence -buying and is resorting to its own version of the gifting scheme promoters' political-fix efforts in Texas. It has introduced a bill in Congress, HR 5230, that would legalize MLM on the grounds that if the price of joining is a "purchase" and the rewards paid out to recruiters are based on money from "purchases" by recruits, the MLM is legalized - the endless chain promise, the purchase quotas and the recruiting mandate notwithstanding.

-buying and is resorting to its own version of the gifting scheme promoters' political-fix efforts in Texas. It has introduced a bill in Congress, HR 5230, that would legalize MLM on the grounds that if the price of joining is a "purchase" and the rewards paid out to recruiters are based on money from "purchases" by recruits, the MLM is legalized - the endless chain promise, the purchase quotas and the recruiting mandate notwithstanding.

This element of the pyramid is plainly seen in the Gifting Scheme. Money from the last eight to join is transferred to the person three levels above. To get rewarded, new people must be found, so everyone on the chain is motivated to bring in others. When the last eight join and pay, the top person is rewarded and the people at each level below move up a level and get closer to their own payday. The plan claims to be able to generate 800% return to all who participate, forever. The money comes from the bottom ranks, is concentrated by a factor of 8, and then is transferred to the top position.

The money transfer in the gifting scheme is total. The transfer is efficient and simple. Every dollar at the bottom goes directly to the top, but the leverage is limited to just 8 to 1. Note: Some variations may involve wily organizers raking off a percentage for themselves so they don't have to actually participate but just get others to do so, equivalent to being MLM "owners.")

In MLM, the transfer is more complicated, seemingly less efficient, even incomprehensible at first study. Not every dollar at the bottom is sent exclusively to the top. Some of the funds are allocated to levels in-between. This is needed because the leverage in a MLM is vastly greater. It may be hundreds of thousands of participants or even millions to one! MLM is a long con. The gifting scheme is shorter and far less leveraged, thus the MLM needs more carrots and lures to get recruits in and keep them paying and recruiting for as long as possible, before they quit in confusion and self-blame. Small amounts are dribbled to levels between bottom and top to grease the recruiting machine and increase the funds paid in by the eventual "quitters."

MLM levels are theoretically infinite but official payment ranks can range from four to twenty-four or more in number. John Oliver characterized Usana's many levels as "Scientology-like", reflecting their honorific role in conferring phony status for purposes of control. The MLM's complex pay formula produces the same pattern of extreme concentration as the gifting scheme's simple one does. At Nu Skin, for example, 80% of all the reward money winds up in the hands of the top 1%. 93% of the participants get paid nothing at all. And since the MLM's use "products" to camouflage the transfer, only about 40-50% of the total "purchase" money paid in by the newest recruit can be transferred as reward. The rest is needed to cover the scheme's product and administration costs, and raked off as "profit" for the owners and their shareholders.

4. Closed Market Swindle, aka. "Lack of Retailing"

The last of the fundamental, defining characteristics of a pyramid scheme is arguably not a "causal" factor, but a consequential one. In the gifting scheme, despite the participants' claims of altruism, it turns out that those who "give" are the only ones qualified to receive "gifts." No one outside the chain of participants is doing any giving or getting any gifts from the participants. The money for those who "receive" comes only from those who "give", with the "gift" being the price of admission. This is obvious and unquestioned. The gifting schemes don't bother to claim that some of the money comes from others who want to give purely for the shared goal of world prosperity.

A closed market, of course, is a fatal flaw in a recruiting-based income promise because the money for rewards can come only from the participants themselves. If 10 people pay $100 each to join, and that's the only source of funds, how can any one gain more than $10 without the others losing? In total, the money is just being transferred among the chain members in a win-lose process. No equitable value is exchanged and no other source of money is involved.

In MLM, just as the pay plan is made incomprehensible for analysis, the closed market is obscured. In addition to claiming that the payments of those inside the chain are "purchases" not payments, it also claims there is, theoretically at least, some money also coming in from outside the chain, obscuring the internal money transfer. This other source is supposed to be "retail sales" by the "direct sellers." John Oliver noted that the MLMs conveniently don't keep retail sales volume records, so the story about significant outside funding remains just part of a cover story.

After two years of investigation, the FTC found that Herbalife displayed the same telltale trait as all the other MLM scams it has prosecuted. Almost all the money is coming from purchases only of those inside the pay plan. A profitableretail selling income did not exist, the investigation found. There are no "customers" of any significance. Thus, the iron law of a closed market - last ones in lose - prevails, making the income promise "inherently" deceptive.

The lack of external funding is often cited as the red flag of a pyramid fraud, but in MLM it could just as easily be seen as a result of the other three elements: the endless chain/recruiting promise of "unlimited" income, the pay-to-play quotas that drive "wholesale purchases" and the extremely leveraged money transfer, capable of delivering massive rewards to a tiny few recruiters from millions of other losers. These three elements alone would prevent any significant retailing from occurring. It is therefore not necessary for regulators to search the world for profitable MLM retailers. They could not survive within the MLM environment.

How could they survive when the company offers "wholesale" pricing to all, low retail profit margin, and keeps adding competitive retailers to each market area? This is on top of the reality that no one needs "personal selling" for a commodity face-cream (even one that promises an end to "aging" or an ordinary protein powder drink that is available for a fraction of the price in stores. The "retail" claim - even backed with official-sounding, but impossible data from the Direct Selling Association - is as fictional as people "giving" money without expectation of the 800% that is promised.

In just 30 minutes, John Oliver was able to explain the essence of the MLM ruse of the endless chain, pay-to-play purchasing, fictional retail sales, non-existent income opportunity, closed market money transfer, phony health claims, and regulatory capture. He made it uproariously funny, though he also showed the tragedy for millions of individuals and for a country that has allowed a pyramid scheme to pass for self-employment and entrepreneurship.

One cannot help but wonder that if a satirist can see and explain the MLM racket with such clarity and power, how is it possible that the FTC and SEC do not and, after Oliver's show, for how much longer?

Robert FitzPatrick (copyright 2016)

No comments:

Post a Comment