| Christine Richard |

For All The Hype About Herbalife's Discount Buyers, We Estimate They Account For Less Than 2% Of U.S. Sales

By Christine Richard

Summary

Herbalife has less than a year to show the FTC that the vast majority of its products are sold to people who have no interest in its business opportunity.

To do this Herbalife must prove that legions of people sign up with the company only to buy the product at a discount for personal consumption.

Herbalife’s disclosure regarding so-called Discount Buyers has been self-serving and misleading since the company came under scrutiny.

We estimate the number of current Discount Buyers, based on Herbalife’s disclosures, past and present, and the FTC’s findings, and discover that they account for less than 2% of Herbalife’s US sales.

The clock is running for Herbalife Ltd. (NYSE:HLF). The company has until May 15, 2017 to show the Federal Trade Commission (FTC) that the vast majority of its products are purchased by consumers, not by distributors who buy Herbalife products to qualify for and generate commissions. Qualification buying is a red flag of a pyramid scheme.

Starting in May, Herbalife will be required to show that two types of individuals account for most of its sales: 1) a newly created category of individuals called Preferred Customers, who sign up with Herbalife just to get a discount on the products for personal consumption and have no interest in pursuing the business and 2) distributors who are pursuing the business opportunity and can verify that they sell the products they buy from Herbalife to Retail Customers at a profit.

In this article, we estimate how many individuals make up the first group, Preferred Customers, and how much product they're consuming. To do this, we reconstruct a metric that the company stopped regularly disclosing in 2012 - the percentage of distributors Herbalife considers to be "Discount Buyers" or people who signed up just to get the product as a discount.

When it stopped including this information in its filings with the Securities and Exchange Commission, management said it believed the information was not valuable to the business or to investors. In fact, this data may be one of the single most important pieces of information for determining whether Herbalife operates as a legitimate direct selling business in the US and whether Herbalife's US business will be able to survive the FTC settlement.

Self-Serving Disclosure

For years, Discount Buyers were little more than an aside, with Herbalife management focusing on distributors who signed up for the business opportunity. Discount Buyers were part of a group of distributors referred to as Non-Sales Leaders (individuals who didn't purchase sufficient product from Herbalife in a year to be eligible for commissions). There were two other categories in this group: Small Retailers, who were happy limiting their business to selling to a few friends or family members, and Potential Supervisors, distributors who were working on building a more substantial business but weren't there yet.

In 2012, Herbalife stopped breaking out Non-Sales Leaders in its filings. Then, in 2013, as Herbalife came under intense scrutiny over the deceptiveness of its business opportunity and the high failure rate of its distributors, management revived its discussion of Discount Buyers and suddenly this group dominated the business. A survey Herbalife commissioned found that Discount Buyers made up nearly two-thirds of its distributors.

With the benefit of evidence obtained in the course of its two-year investigation, the FTC concluded certain Herbalife-commissioned surveys were "flawed and unreliable." It noted, for example, that one survey classified people as becoming distributors primarily to obtain product discounts even when those same individuals reported leaving Herbalife because "finding new customers was too difficult and/or time consuming" or that "the business was harder than [they] originally believed."

Here's how Herbalife's disclosure regarding the relative importance of Discount Buyers evolved:

"We have two core, two core businesses. We have a business opportunity, which is why most of our distributors come here. They come here to look for a business opportunity."- CEO Michael Johnson, 2005"[D]iscount buyers . . . who have signed up as distributors to enjoy a discount . . . are approximately 29%."- 10-K for 2010For "complete transparency," for the full year 2011, "discount buyers were 27 percent."- 8-K filed May 2, 2012"Fact: 73% of Former Distributors Joined for Product Discounts."- Jan. 10, 2013 (Investor Day)"90% buy for one reason - self-consumption."- Jan. 10, 2013 Michael Johnson Interview on CNBC

How is it possible that Discount Buyers went from 27% of Non-Sales Leaders in 2012 to 90% of all distributors less than two years later?

This remarkable shift was certainly convenient. The higher the number of Discount Buyers in Herbalife's ranks, the stronger the company's defense against critics who said Herbalife's own US Statement of Average Gross Compensation indicated that only a tiny fraction of distributors earn any money.

The company insisted that Discount Buyers, though included in the compensation table, didn't sign up with Herbalife to make money; they were consumers, not business opportunity seekers, so attempts to analyze Herbalife's business opportunity with these individuals in the data were guaranteed to skew the analysis toward the erroneous conclusion that most people signing up with Herbalife failed at the business. The presence of a large number of supposed Discount Buyers in the data made it impossible to draw conclusions about the business opportunity.

Thanks to some additional information about distributor buying patterns provided by the FTC in its complaint, we believe we can come up with a realistic estimate of the number and importance of Discount Buyers, and by extension, a realistic estimate of the number and importance of Herbalife's future Preferred Customers.

Counting Discount Buyers

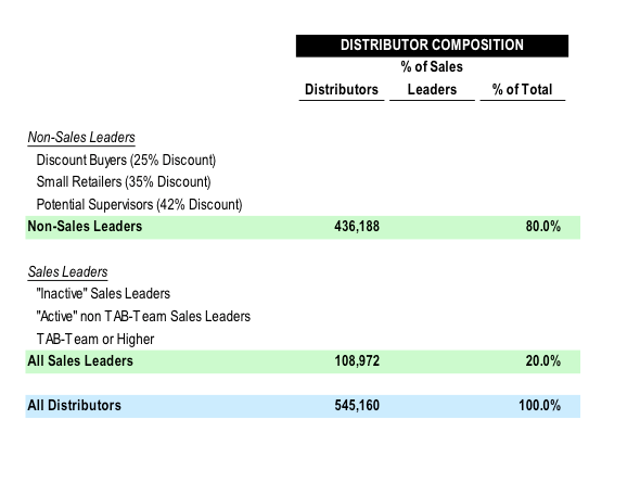

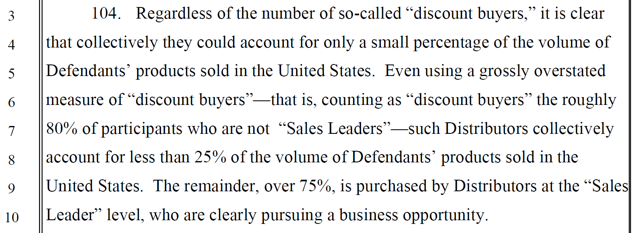

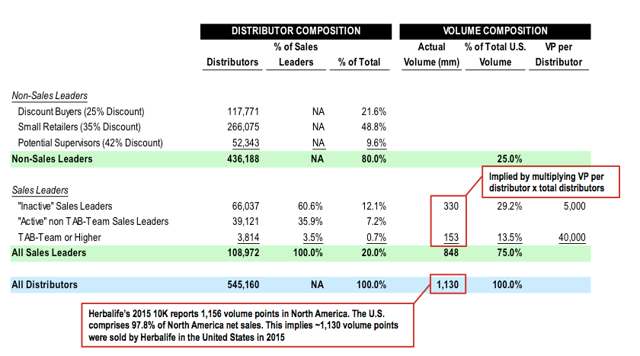

We start by creating a table with six categories of distributors. Three of these categories are for Non-Sales Leaders, which includes the category we are most interested in - Discount Buyers - as well as Small Retailers and Potential Supervisors.

There are also three categories of Sales Leaders (distributors who buy enough product from Herbalife in a year to qualify for commissions). These include Inactive Sales Leaders, distributors who bought enough to qualify for commissions but aren't regular buyers; Active non-TAB Team members, distributors on the lower end of the Sales Leader ladder who buy regularly; and Active TAB Team members, the highest-ranking Sales Leader who make regular purchases.

Herbalife's 2015 US Statement of Average Gross Compensation disclosure table along with its 10-K give us enough information to estimate the total number of distributors in the US and to break that into the number of Non-Sales Leaders and Sales Leaders, as follows:

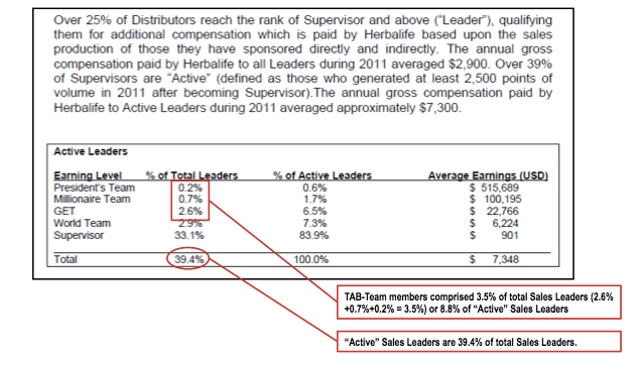

Herbalife's more detailed 2011 U.S. Statement of Average Gross Compensation, shown below, provides the basis for breaking Sales Leaders into different categories.

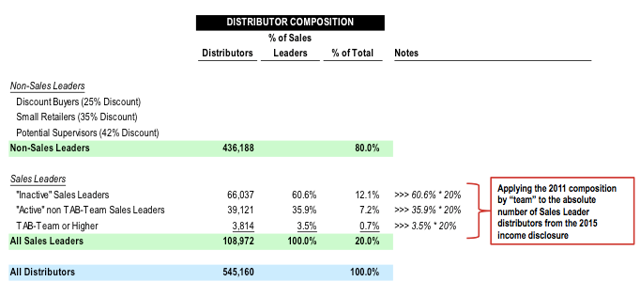

By applying this breakdown to the absolute numbers of Sales Leaders for 2015, we can determine the absolute numbers of Sales Leaders in each of our categories:

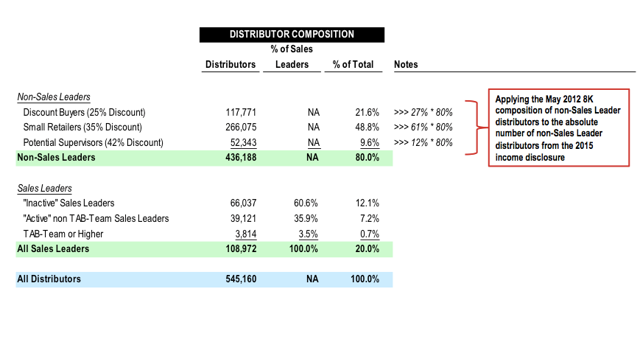

To determine the breakdown for non-Sales Leaders, we go back to Herbalife's May 1, 2012 earnings call when hedge fund manager David Einhorn phoned in with some questions, including: Why did Herbalife stop breaking out the various categories of non-Sales Leaders in its 2011 10-K?

Here's part of the answer, which the company filed in an 8-K:

We did not include the percentages from the 2011 Form 10-K in our more recent filings because we do not view the information as valuable to the business or to investors. For complete transparency, however, the full year 2011 information is as follows:· Discount buyers were 27%· Small retailers were 61%· Potential supervisors were 12%

By applying these percentages to 2015 sales, we can fill in all the categories of non-Sales Leaders, including Discount Buyers.

The result: Discount Buyers in the US totaled 117,771 in 2015 and made up 21.6% of all US distributors.

That's significantly lower than the figure Herbalife disclosed in 2012 when it said it 27% of its distributors fell into the Discount Buyer category. It's also a very disappointing number given the statements Herbalife has made in recent years about the vast majority of its distributors signing up just to get a discount on the products.

But let's keep going, because what we really want to know is how much of Herbalife's U.S. sales were made to these 117,711 Discount Buyers.

Discount Consumer Purchases

The FTC provided a crucial data point in its complaint that allows us to add volume composition to our table. The FTC stated that Sales Leaders purchaseat least 75% of Herbalife's products while non-Sales Leaders purchase less than 25%.

We add this information to the table.

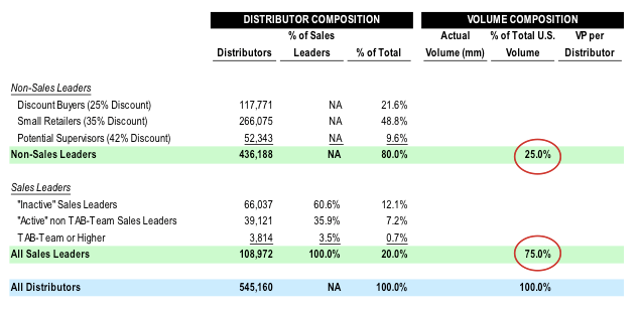

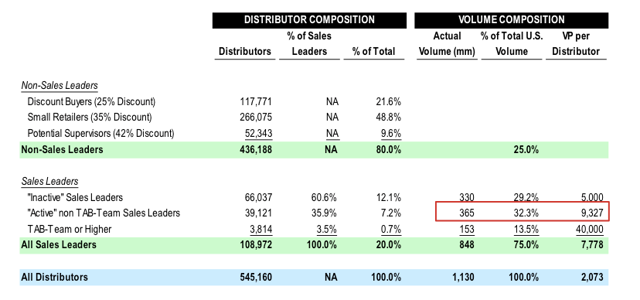

The FTC also provided a second piece of information in its complaint that allows us to break down the distribution of product purchases within the Sales Leader category. The agency noted that TAB Team members buy about 8x the amount of product purchased by lower level Sales Leaders.

This will be helpful once we can establish how much Inactive Sales Leaders are purchasing. By consulting the Marketing Plan, we can make a reasonable estimate. We know they must be purchasing at least 4,000 volume points a year in order to be considered Sales Leaders. But they can't be purchasing 7,500 volume points or more or they would be considered Active Sales Leaders. So we estimate purchases of 5,000 volume points per year for each Inactive Sales Leader and add it to the table below.

Now, we can estimate that those in the TAB Team or Higher are buying on average 40,000 volume points a year because the FTC said that the average TAB Team member or Higher purchases about 8x the amount purchased by lower level Sales Leaders. We add the 40,000 volume points to the table.

By multiplying the volume points per distributor by the total number of distributors in each category, we come up with the total volume points being purchased by these two groups of distributors:

Now we can plug in the missing values for Active Non-TAB Team, and we've established everything we need to know about the Sales Leader groups:

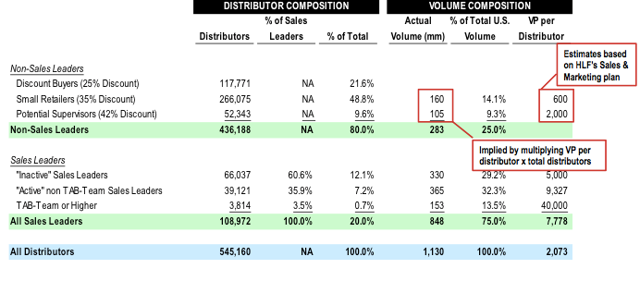

This leaves us to determine Non-Sales Leaders, including the crucial Discount Buyers - the individuals who interact with Herbalife solely to get a discount on the product and who must exist in substantial numbers in order to legitimize Herbalife's business in the eyes of the FTC.

In the 8-K Herbalife filed following David Einhorn's question back in May 2012, the company not only revealed the breakdown in Non-Sales Leaders by motivation, but it explained how it arrived at these various categories. The groups correspond to distributors who have achieved various levels in the marketing plan, which entitle them to different discounts on products:

· Potential Supervisors were buying at a 42% discount, putting them at the "Success Builder" level in the marketing plan.

· Small Retailers were buying at a 35% discount, making them "Senior Consultants."

· Discount Buyers were buying at a 25% discount, which is the discount available to "Distributors."

Using the marketing plan, we can estimate, on average, how much Potential Supervisors, a/k/a Success Builders, are buying. A Success Builder is defined as a distributor who has purchased 1,000 volume points in a month or 2,500 volume points over three months. If the distributor had purchased 4,000 volume points over a one-year period, he or she would have advanced to the higher level of Sales Leader. We therefore conservatively estimate that Potential Supervisors buy on average 2,000 volume points a year.

Again, using the marketing plan, we estimate that Small Retailers, a/k/a Senior Consultants, are buying on average 600 volume points a year. To reach the Senior Consultant level, an Herbalife distributor needs at least 500 volume points, but with more than 1,000 volume points in a month or 2,500 volume points over 3 months, the distributor would be bumped up to a Success Builder.

Using these estimates, we can now fill in the total amount of product purchased by these two groups of Non-Sales Leaders:

We now only need to plug in the missing values for Discount Buyers.

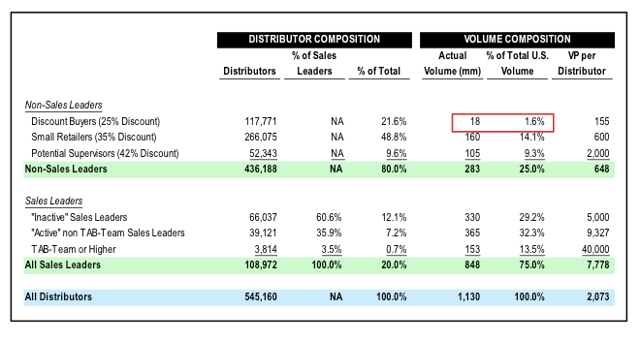

The result: Discount Buyers purchased 18 million volume points in 2015, accounting for just 1.6% of U.S. sales.

Falling Short

Let's review: The FTC says sales to Preferred Customers and to distributors who sell on to Retail Customers must account for two-thirds of Herbalife's sales, if the company is to continue to pay the same level of commissions to its distributors. We considered one category in this article - Preferred Customers - and estimated the size and importance of this group by reconstructing the ranks of Discount Buyers, a metric Herbalife stopped regularly disclosing in 2012.

Recall that Herbalife set our expectations very high for this group, with periodic claims such as CEO Michael Johnson's statement in 2013 that 90% of distributors sign up for one reason only - to consume the product.

Discount Buyers are vital to legitimizing Herbalife's U.S. business because they have no interest in pursuing the business. They are a testament to the underlying demand for the products. These individuals are so pleased with Herbalife products that they are willing to make an upfront payment in order to get discounts on future purchases and they're willing to go through the hassle of signing a contract in order to get that discount. They are what one might call "loyal customers."

The problem is that they make up only 22% of all distributors, and they buy less than 2% of the product Herbalife sells in the US.

They are essentially irrelevant.

Christine Richard (copyright 2016)

No comments:

Post a Comment