Summary

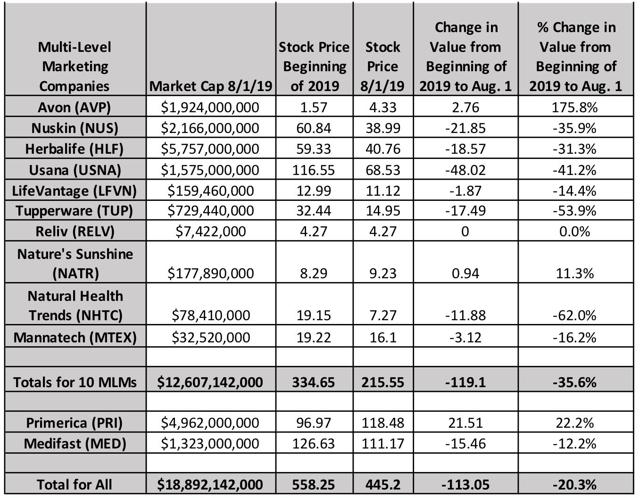

Stock values of 10 of the 12 publicly traded "multi-level marketing" (MLM) companies, including Herbalife, Nuskin and Usana, have lost over a third of their value since the start of 2019.

Understanding of MLM and its "endless chain" model is lacking on Wall Street but support continued during the short selling revelations and FTC prosecution of Herbalife. This is changing.

Investor concerns focus on market saturation for recruits and law enforcement against pyramids and bribery in China and other countries. MLM is illegal in China yet MLM recruiting is rampant.

Growth or decline in MLM is the result not of product demand but of recruiting and Wall Street has made little or no inquiry into how MLM recruiting works.

Public sentiment and popular media treatment of MLM are increasingly mocking, critical and condemning. This erodes investor confidence in MLM stocks.

Vanishing Equity

The smoke has long since cleared from the fields of Herbalife where William Ackman and Carl Icahn famously did battle for five years with stock purchases, research reports, threats of lawsuits, short-squeezes, claims of pyramid fraud and cultism, claims of stock manipulation, press conferences – all chronicled in a Netflix documentary. Wall Street revealed confusion and lack of knowledge about what exactly Herbalife’s “multi-level marketing” business model is, while also asserting that it did not need to know. Profit, growth data and longevity were sufficient. Even after an investigation and prosecution of Herbalife (HLF) by the Federal Trade Commission, which verified most of Ackman’s charges, Wall Street maintained financial support or neutrality toward the “MLM” sector. This is changing.

The aggregate equity of 10 of 12 publicly-traded MLMs, including Herbalife, lost over a third of its value since the beginning of 2019. Stock values of two companies, anomalously, increased but one of them, Avon (AVP), has been in a deadly decline for several years. It spiked a bit recently on expectation of a take-over. Avon and Tupperware (TUP), once industry icons touted to challenge anyone who questioned the legitimacy of "MLM" are both in steep decline. The market capitalization of the two together is down 74% in the last five years. One publicly traded MLM, Medifast (MED), has been spiraling upward in price and remains near record high though its stock suffered a double-digit drop in the last seven months. Altogether, 12 companies have dropped 20% in aggregate value since the start of this year.

The MLM sector consists of a dozen or so publicly traded MLMs, including Herbalife, with aggregate capitalization of about $20 billion. Added to this, there are hundreds of privately-held “MLMs”, some much larger than the public ones.

Amway, the template on which all other MLMs are based, is the largest with revenues over $8 billion globally. Collectively, MLMs solicit “business opportunity” investments from tens of millions of consumers in the form of "distributorships" with related fees, training costs, and product purchases. In the USA, MLM claims to generate over $35 billion in revenue (unverified) yearly. MLMs have their own PR and lobbying organization, the Direct Selling Association, based in Washington DC.

Though MLMs sell many different products, they require a unique trade group due to their anomalous business model. This model makes the amazing claim to a non-diminishing market, without demographic and economic limits. It claims to be able to expand and enlarge its distribution channel perpetually to “infinity”. This fantastic claim undergirds its equally unfathomable promise to provide “unlimited” income potential to all consumers it solicits investment capital from, no matter when or where they are enrolled. The claim is based on the alleged capacity to expand forever, regardless of competitors, market sizes, or national economic conditions. MLM financial solicitations are not covered by Franchise rules and are exempt from the FTC's Business Opportunity Rule. No financial disclosures are required during solicitations.

If McDonalds were an MLM it would continuously sell new franchises – without providing income and cost disclosures – in every neighborhood, claiming its market for hamburgers and for franchisees “has no cap.” As its newest franchisees went out of business in droves, it would claim the “losers” did not work hard enough or were negative thinkers. If all MLMs were one tradable security, it would sell an infinite number of shares, while telling all new shareholders their capital gain potential is "unlimited" because there will always be new buyers willing to pay a higher price as new shares are issued.

The footprint of MLM on America is a heavy one. Rates of loss, measured over multiple years, come close to 100% for the newest recruits. Succumbing to MLM's great promises and then suffering a loss, as most do, can cause disruption of families, bankruptcy, interruption of education, divorce. Despite this, the workings of MLM recruiting are not studied in universities. The FTC has never done an industrywide study. MLM’s financial solicitations have never been addressed by the Consumer Financial Protection Bureau.

Bigger than Pop and Drop

After a favorable settlement with the FTC, negotiated by the FTC’s previous chairperson, Jon Leibowitz, who had gone directly to work for Herbalife after leaving his post at the FTC, and with Herbalife’s CEO Michael Johnson proclaiming Herbalife’s legitimacy, the stock boomed. Wall Street took the stock from its depth of $13 when the revelations seemed irrefutable, all the way up to over $60 as late as February this year. Today (Aug. 12), Herbalife stock sells for $37, a 38% drop from this year’s (2019) high. What happened to cause $3.2 billion in market capitalization to vanish in just 6 months?

Individual MLMs are famous for “pop and drop” revenue gyrations but this stock price trend is wider. Since the start of this year, Wall Street has reduced its investment in twelve publicly traded “MLMs”, in aggregate, by 20%. Thirty-six percent was withdrawn from ten of the twelve. During this same time, the S&P rose 18%. Of these ten showing the largest drop in aggregate, Avon had a large percentage gain this year, but its Aug. 1 price is 26% lower than the start of 2017 and about 70% down from five years ago. Its recent rise is partly attributed to an expectation of being acquired by a Brazilian MLM. It has already sold off its North American operations.

No market-based causes are detectable. No drastic recent change has occurred in MLM revenues. MLM enterprises have not been disrupted by technology or any AI development. Its “direct selling” model based on millions of people selling these commodity products “one-to-one” in the home has never been explained or justified in the era of dual wage-earning households, eBay, Amazon, and Costco. The industry has never verified the existence of any significant retail customer base. Its “direct selling” business model, therefore, makes no more and no less sense in 2019 than it has for decades since the Fuller Brush salesperson vanished.

Emerging Wall Street Awareness

In recent years, Wall Street has, finally, accepted the reality of a distinct MLM sector. No longer are “MLMs” categorized by product or treated as modern-day, door-to-door encyclopedia sales operations. They are now categorized by unique “business model”. Because its impossible “endless chain” structure would make any income promise based on it inherently deceptive, most regulators until about 1980 treated the model as illegal. And though this sector includes very large companies and some others that are quite small by comparison, many analysts are now realizing that MLMs are all one syndicate, promoting a single dogma based on faith in the endless chain proposition. Large or small, the common need of all MLMs to uphold the “direct selling” identity, promote belief in the “unlimited income” promise, deflect pyramid scheme charges, and lobby against regulation means that whatever happens even to a small MLM can have a major impact on all others.

Beyond this general new awareness on Wall Street, I detect an emerging Wall Street interest in two key aspects that are relevant to the recent MLM sell-off. These are risk of fraud prosecution and the physical realities of saturation. These two aspects have recently coalesced in the critical and final global market of China. The qualified question I get asked repeatedly by analysts is: We are not interested in MLM legality or its effect on consumers; what we need to know are: how long will the music last, and, will the US or some other government finally crack down? With Donald Trump in office, a former MLMer himself, they recognize that MLM is currently safe from prosecution in the USA. It is mostly in China where risk of regulation exists. Other countries could also act. But China is also crucial to the saturation specter, a double threat.

The specter of global saturation is tangible and easily grasped. Amway led the way as the first international MLM and was among the first to get into China. It is by far the largest MLM in China. Before entering China in the early 1990s, Amway’s revenue languished, as geographic saturation took its toll. Then, revenue skyrocketed after Amway launched its massive recruiting program in Mainland China. But, in the last few years global revenues took a steep dive, dropping about 30%. What China gave; it took away. With 50-80% annual "attrition", the Pop and Drop pattern is offset by expanding territory or sometimes recasting under a new name or new product line, but now there is no more territory for Amway to go to. Other MLMs are following Amway’s path to Drop.

Gauging the regulatory environment in China is more complicated. After banning all direct selling in the late 90s, in 2005 China enacted the most “anti-MLM” law in the world, on paper. “MLM” is officially illegal in China. So, whereas all the MLMs in the USA say they are not pyramid schemes, in China they all say they are not MLM! Yet, as researchers from short sellers and major news organizations have verified, recruiting is rampant and creates the same mania in China as it does everywhere else. Amway’s newest millionaire “Diamonds” are mostly from China, and that kind of money cannot be gained from personal “direct” selling. Hope for MLM's promised "unlimited income" has spread among China's billion-plus population. Millions are drawn by the amazing proposition, which is described by MLM promoters as the purest form of capitalism, the American Dream in a box.

The clearly worded law that outlaws MLM recruiting in China and the widespread flouting of that law, using semantics and fig leaf modifications, create a special challenge for MLMs in China. They cannot set up a K-Street lobbying organization in China to openly influence the single-party government. Other forms of influence-buying must be carried out, e.g., sourcing supplies from favored vendors in China, giving key government officials “scholarships” to attend Harvard, as Amway did in partnership with Harvard, and building production facilities in China. The risk of being viewed as a corrupt corporate briber is very high. Nevertheless, MLM’s fortunes in China hinge on influence-buying. It would not be unrealistic to speculate that one MLM might successfully “influence” the government to enforce its law on other MLMs as saturation reaches critical points, and with billions at play on MLM stocks affected by prospects of Chinese regulation, the potential for securities abuse and manipulation also looms large.

Inexplicable “Growth” as Red Flag

While broad revenue decline related to saturation or threats of government regulation are being recognized as red flag risks in the MLM sector, Wall Street still does not inquire into the corollary risk indicator that MLMs are famous for – inexplicable rises in revenue. Explosive increases in MLM revenues are always – without exception – the result of intensified recruiting and ramped up “income opportunity” claims. Sudden rises unexplained by larger market trends or differentiation can signal impending steep drops or unfavorable attention from regulators and class action lawyers.

The scale and impact of MLM recruiting – the existential requirement for gaining revenue – is best exemplified by Primerica (PRI), a purveyor of term life insurance sold by hundreds of thousands of newly recruited “agents” who are also customers of their own products and are offered the incentive to recruit yet more “agents” for overrides. From the start of 2019 to August, Wall Street boosted Primerica’s stock almost 30%. In the latest annual report, Primerica confirms the existential reliance on recruiting:

“…over the longer term, our sales volume will generally correlate to the size of the sales force.”

Consider these astounding figures from Primerica’s 10K that document the enormous scale of Primerica’s recruiting, remembering there are hundreds of other MLMs all engaging in the same relentless solicitations for their own "agents" year after year. At the start of 2014, Primerica had 95,566 “insurance licensed sales representatives.” Through 2018, a period of five years, Primerica recruited 1,276,000 (1.276 million) new recruits in the USA and Canada. At the end of the period, 130,736 were working. To increase its sales force by 35,170, it had recruited 36 times that number! MLM recruiting with such a massive attrition rate may seem a costly and unproductive activity for the MLM company but it can actually be profitable. The recruits themselves find and refer new people and each new recruit pays to gain access to the “income opportunity.” Many even pay to attend “motivation” events and annual conferences. At Primerica, those 1.276 million new recruits, over 97% of whom washed out, each paid $99 to enroll and $25 a month for the “back office online services” for as long as they remained.

For the MLM, Medifast, a seller of “meal-replacements” the stock price is down more than 12% at the beginning of August from the start of 2019. That price, however, is 170% above what it sold for at the start of 2017. Its revenues have risen steeply while its product line and business model remain largely unchanged, except to have undergone a makeover in words and names. Medifast changed the name of its MLM channel from Take Shape for Life to Optavia (pronounced Opta-Via) and created a new logo.

As it did during the Great Recession when the meal replacement market crashed and well before the logo/name make-over, Medifast is currently outperforming all other companies selling similar products - Weight Watchers, Nutrisystem and Jenny Craig – and growing far faster than its industry. Optavia meal replacements are similar to and priced about the same as the others, $300-$400 a month, but none of those other companies uses the MLM model that couples buying products with an “income opportunity.” Medifast’s recent success is directly tied to a spike in the recruiting of sales-and-recruiting contractors, called "coaches", that pay $199 and other costs to participate in the “income opportunity”. Medifast makes the connection between recruiting and revenue clear in its 10K.

“Our success in creating the OPTAVIA community, and achieving the desired results for our clients, is reflected in the growing number of active earning OPTAVIA Coaches. The total number of active earning OPTAVIA Coaches as of December 31, 2018 was 24,100.… OPTAVIA Coaches are subject to high turnover and we depend on our network of OPTAVIA Coaches to continually grow their businesses by attracting, training and motivating new OPTAVIA Coaches. We consider our number of OPTAVIA Coaches and revenue per OPTAVIA Coach to be key indicators of our financial performance and condition.

It might be assumed that Medifast’s rise in revenue and recruiting is from delivering significantly greater financial rewards to more recruits. However, Medifast’s own disclosure states that 87% of all its “coaches” in 2018 earned less than $5,000, before all purchases and business costs are deducted. 31% earned no income at all while remaining in the business more than a year, on average. It does not disclose total recruiting or attrition rates.

MLM Recruiting: The Black Box

Wall Street assigns MLM value and assesses its future prospects from revenue data. But the MLM revenue depends directly – existentially – on recruiting more people who recruit more people. MLM has no breakthrough technology to sell, no unique products and no price advantage. Its sales forces and its customer bases, which are often one and the same, turn over in staggering rates of attrition. Recruiting ever more people into its “income opportunity” is MLM’s core competency. The MLM “opportunity” is the real and defining product of all MLMs, not “pills, potions and lotions”, manufactured meal replacements or term life insurance.

MLM recruiting campaigns are expertly designed, coordinated, targeted, scripted and executed just as branding campaigns are for conventional companies. Branding programs are carefully studied by Wall Street analysts. Yet, in my experience and from my Wall Street consultations, I can attest that Wall Street does not have a clue how MLM recruiting works and therefore its analysts have no way to measure or anticipate risks of downturns.

Or Maybe It’s Just The Comedians

Wall Street’s pull-back on MLM stocks might not involve the insights or observations of its analysts. It’s possible that the professionals have not even taken notice of global saturation scenarios. It’s conceivable they have not read China’s anti-MLM law, looked into the regulatory climate in China or examined the risks of violating the Foreign Corrupt Practices Act.

Maybe, along with 20 million other people, they just saw the HBO John Oliver Show on YouTube in which he deconstructs the entire MLM industry in just 30 minutes and with humor, characterizes it as a scam of epic proportions. Or maybe they watched the segment of the Canadian hit comedy on Netflix, Schitt’s Creek that includes a hilarious vignette of classic MLM deception among friends and a local saturation scenario. Or they might have joined millions of others who saw Samantha Bee’s comical evisceration of MLM in which she acknowledged that just the mention of “multi-level marketing” probably makes her viewers “flinch.”

Wall Street professionals not into comedy might have been affected, along with millions of others, by the 11-segment Podcast, The Dream, that examines MLM’s strange history and extensive political influence-buying. Or if they missed all that they might be factoring into MLM stock values the effect of the upcoming series on Showtime, On Becoming a God in Central Florida, starring Kirstin Dunst as a “minimum-wage-earning water park employee who schemes her way up the ranks of Founders American Merchandise, a cultish, flag waving, multi-billion dollar pyramid scheme that drove her family to ruin.”

Robert FitzPatrck (copyright 2019)